Over One Hundred Years of Injustice

My conviction for income tax crimes has happened to many other citizens inside the United States since 1916 with no basis in law. This is because Congress repealed the income tax inside the United States in 1916.

I relied on Section 861, “Income from sources within the United States,” which, like its predecessors and the legal meanings of familiar words in Section 7701, proves that the federal income tax only applies when income crosses national borders (foreign connections).

The IRS, prosecutors, and courts assume that the tax applies inside the United States when Section 861 proves otherwise. This website provides the original documents, statutes, and clear explanations that reveal how federal lawyers ignore the law, substituting their BELIEF.

Search Warrant

Short paragraph explaining that the search warrant was issued without probable cause and why that’s unconstitutional.

Indictment

Short paragraph showing that the indictment charged you under statutes that legally don’t apply to you.

Trial Files

Short paragraph explaining how the trial proceeded without lawful authority, hiding the definitions and real law from the jury.

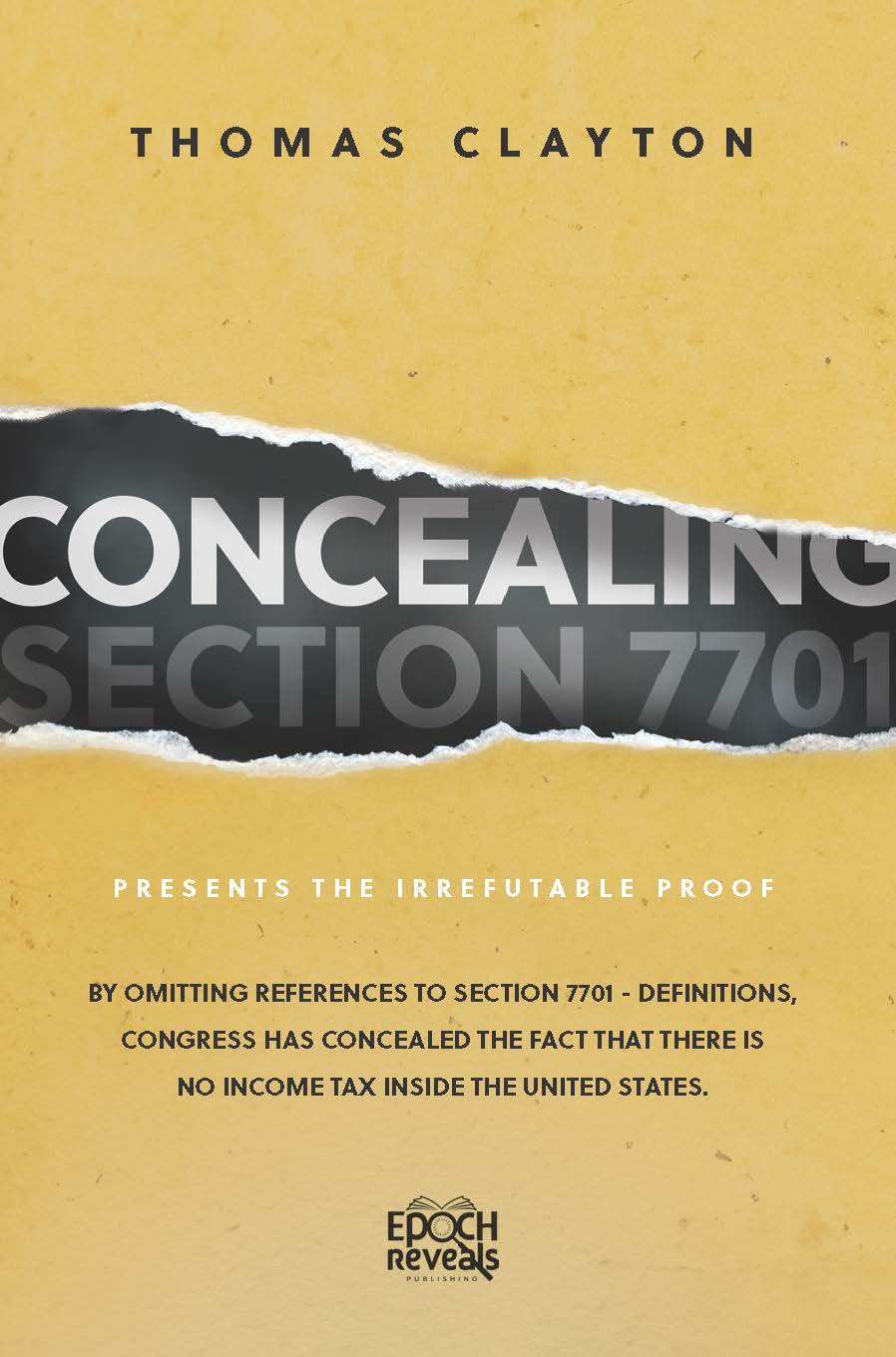

Legal Definitions That Were Hidden

Short paragraph explaining that Section 7701, withholding, and Subchapter N were concealed from juries.

Illegal Prosecution - Big Picture

Short paragraph summarizing that every citizen inside the United States with no foreign connection has been illegally prosecuted or forced to pay.